Thanks to the financial derivates almost anyone is able to trade commodities. But it also means that it is not enough to “trust the commodity”, it is also necessary to have knowledge about how modern trading works and what risks it brings.

What actually is a commodity? In simple words, they are products of equal quality and price that are produced by a large number of producers. That means that commodities are not mobile phones that are different in many characteristics. Commodities are divided into several groups: energy such as oil or natural gas; metals, but not only precious metal such as gold, silver, platinum or palladium, but also for example copper; agricultural products (various types of crops, cocoa, coffee, meat, cattle or even orange juice). Every commodity stock exchange where trading is happening have specified required parameters of selected commodities and the quantities that may be traded.

Given the characteristics of commodity stock exchanges where even the smallest price movements are watched closely, it is natural that leverage products – such as contracts for difference (“CFD”) – are used. When prices move, the money difference is paid based on this contract. In the case of price growth, the buyer pays money to the seller, in case of price decrease, money is paid in opposite direction. CFD are derivatives that enable speculations on price movement, without actually owning the underlaying asset – in this case the commodity.

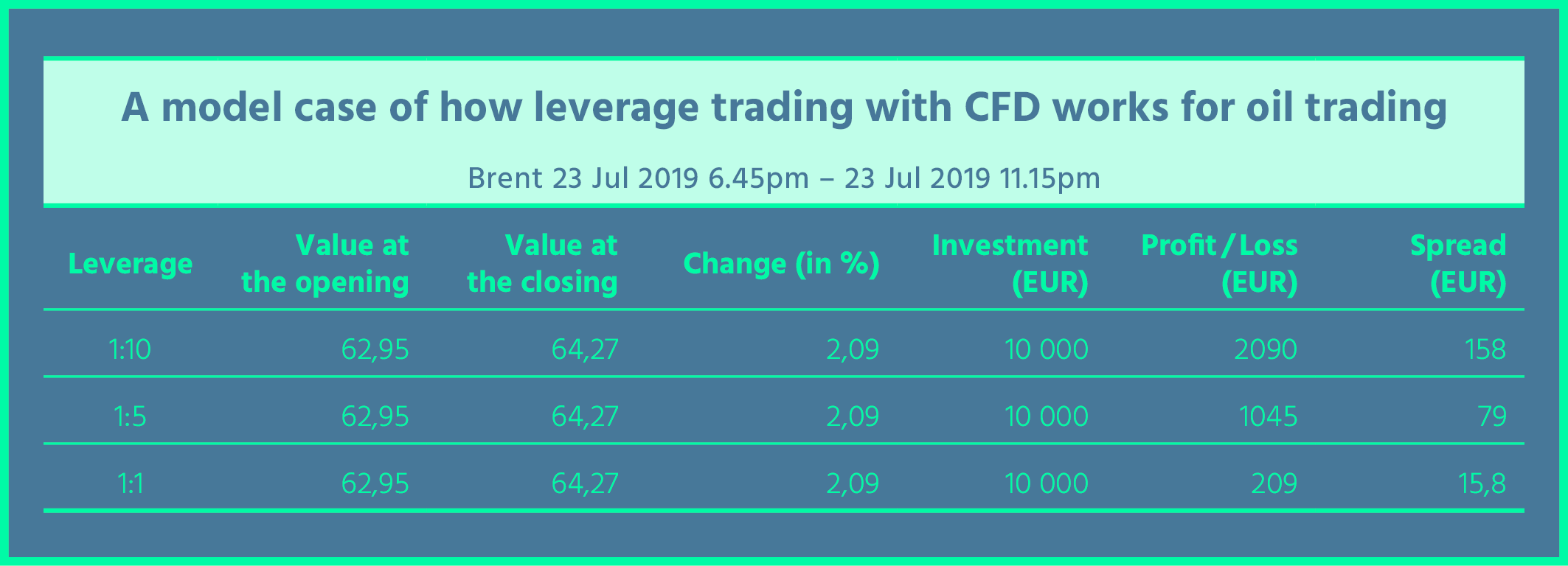

We present you commodity trading using CFD and financial leverage using the following model case. Crude oil Brent had the value of 62.95 USD on 23 July 2019 at 6.45pm and then the value of 64.27 USD at 11.15pm. This represents a growth of 2.09 %.

In the table you may see examples of trades with leverage. Currently a leverage of 1:10 is applied when trading crude oil using CFD, our model in the table shows situations and profits/losses in cases, when leverage is lower or none at all. It is a speculation on price growth, which means we gain profits if the price grows and get losses if the price goes down.

* Charges: the table shows so-called spread, that is a charge of the broker which is calculated from trader’s profit from the difference between buying and selling price. More information about charges and detailed calculations are available in https://alpho.com/.

The scenarios are valid for a trader that has opened his position on 23 July 2019 at 6.45pm while the value of oil was 62.95 USD and closed his position on the same day at 11.15pm at the value of 64.27 USD. In this time frame the Brent oil has grown by 2.09 %. The trader, as mentioned before, has speculated on growth. Without using any financial leverage his profits would be 209 EUR from an investment of 10,000 EUR. We can’t say this would be an unsuccessful trade, rather vice versa. If the trader speculated on price decrease, he would lose money. The speculation on growth was a good strategy in this case.

However, profits may be multiplied using financial leverage, for example in the ratio of 1:5. The trader would then reach a profit of 1,045 EUR from the same investment. When using leverage ratio 1:10, which is currently used for trading oil, the profit would be 2,090 EUR.

Capital markets regulation in the EU allows the maximum leverage level of 1:10 for commodity trading. In the same way in which leverage multiplies profits, it can also multiply losses. If the trader speculated on price decrease, he would end up with a loss of 2,090 EUR when using financial leverage of 1:10. That means he would lose almost one quarter of his investment during mere 4 hours.

As we showed you, it is a very risky product, which also means that no credible institution offers commodity trading with acceptable outcome from investment questionnaire. By law, all potential clients must fill it in before they can be offered such risky products.

Leverage trading has a long history

A first traded using financial leverage was a purchase of Pan-Atlantic Steamship Company by the company McLean Industries, Inc., in January 1955. Nowadays these trades are known as leveraged buyout. These buyouts were most popular in 1980s. CFD as know them now were introduced in London in 1990s. Brian Keelan and Jon Wood from the company UBS Warburg are usually named as founders of the instruments. CFD were frequently used by hedge funds and other institutional traders thanks to the possibility to trade without actual physical owning of the underlying asset. This way they avoided numerous high charges.

Towards the end of 1990s, thanks to the development of Internet and other means of communication, the possibility to trade CFD reached retail investors. Internet and other developments enabled watching every price movement and trade immediately. Many new online trading platforms and mobile applications were created subsequently and simplified trading even more. Thanks to easy access, capital markets trading has become a widespread matter.

Risk warning: Financial contracts for difference are complicated instruments and are connected with high risks of fast financial losses due to trading with leverage. 80.49 % of retail investors accounts have experienced financial losses from trading with contracts for difference with this broker. You should consider whether you fully understand how financial contracts for difference work and if you are able to undergo high risks of financial loss. Trading with leverage products, such as CFD and FX, are accompanied by a substantial risk of losses and may not be suitable for all investors. Trading with these products is risky and may cause a loss of all invested capital.